DCU and First Technology Federal Credit Union have merged. First Tech members: please continue managing accounts and requests through the First Tech website. As we work to combine operations, we look forward to delivering even more value to you and the communities we serve. LEARN MORE

Featured Results

Your Recent Searches

No Recent Searches Found

Did you mean:

But let's try once more with some tweaks

- Make sure all words are spelled correctly

- Try using fewer words

- Try using more general keywords

- Try different keywords or spellings

Sorry, We couldn't find what you are looking for. It could be because of many reasons.

But let's try once more with some tweaks

- Make sure all words are spelled correctly

- Try using fewer words

- Try using more general keywords

- Try different keywords or spellings

- Hero 1

- Hero 2

- Hero 3

- Hero 4

We're a Credit Union Catered to You.

DCU Support Center

Need help? Quickly access Digital Banking tasks, FAQs, forms, and more.

Membership Application Status

Check status, continue an application, upload documents, or send a secure message.

Loan Payments

Make a one-time payment for non-real estate loans using SpeedPay.

Schedule an Appointment

Schedule an appointment with a specialist to discuss your personal or business banking needs.

Benefits & Offers

Whether you’re in need of personal banking or business banking, DCU has helpful tools & resources for you.

FINANCIAL EDUCATION

Financial Education Center

Achieving your financial goals starts with education.

FINANCIAL EDUCATION

Financial Education Center

Achieving your financial goals starts with education.

Investment Management

Digital Investment Services

Financial guidance from professionals who know the market.

Investment Management

Digital Investment Services

Financial guidance from professionals who know the market.

General Deposits

Take care of your money

Find out about our free checking and high-yield savings accounts.

General Deposits

Take care of your money

Find out about our free checking and high-yield savings accounts.

DCU in the Community

What makes Digital Federal Credit Union Different?

More Control for You

At a not-for-profit, member-owned organization, you’re an owner – not a number.

LEARN MOREBALANCESM Program

Helping you build a better financial future with free, trusted guidance; and resources.

LEARN MOREPeople Come First

It’s our mission to make a meaningful impact for our members and their communities.

LEARN MOREYour Opinion Counts

We invite you to share your feedback about DCU's products and services.

LEARN MOREDCU for Kids

Our 501 (c)(3) non-profit charitable foundation to benefit children and families.

LEARN MOREBank With Us From Anywhere

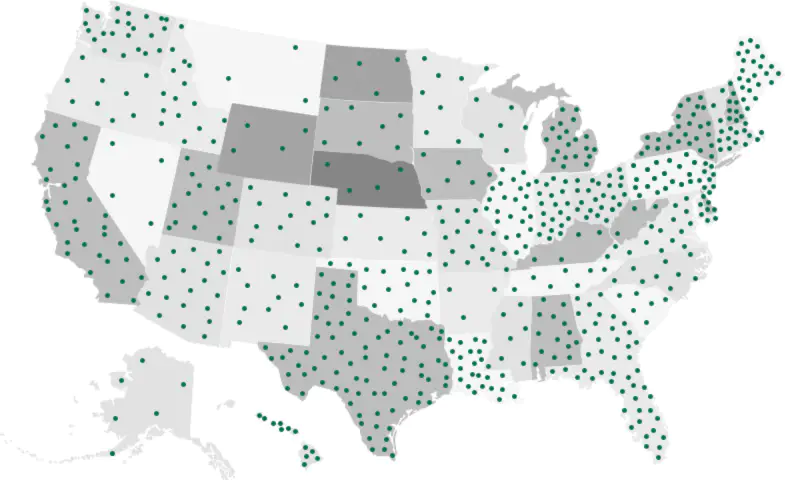

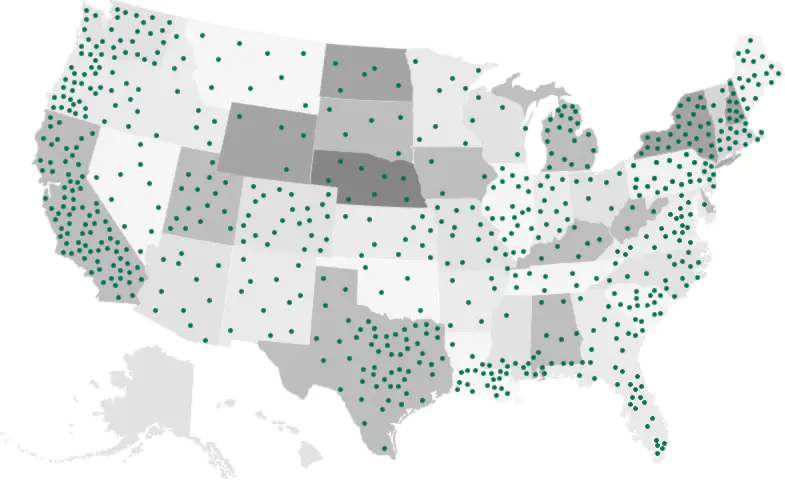

- 5,900+ Co-Op Shared Branches in the United States

- 80,000+ Surcharge Free ATMs in the United States

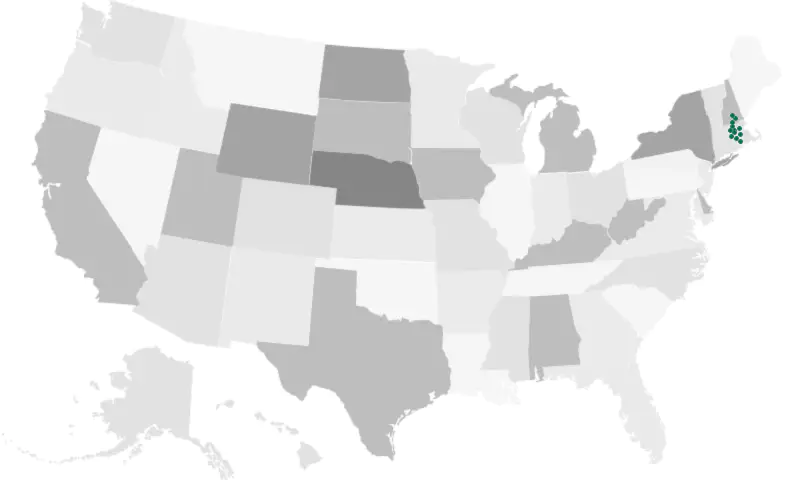

- 23 DCU Branches in MA & NH

- ATMs near your location