Video: Account takeovers are on the rise. Remember to do your part, be smart, and protect yourself against fraud. WATCH NOW

DCU Routing Number: 211391825

Featured Results

Your Recent Searches

No Recent Searches Found

Did you mean:

But let's try once more with some tweaks

- Make sure all words are spelled correctly

- Try using fewer words

- Try using more general keywords

- Try different keywords or spellings

Sorry, We couldn't find what you are looking for. It could be because of many reasons.

But let's try once more with some tweaks

- Make sure all words are spelled correctly

- Try using fewer words

- Try using more general keywords

- Try different keywords or spellings

We're a Credit Union Catered to You.

How can we help?

DCU Support Center

Need help? Quickly access Digital Banking tasks, FAQs, forms, and more.

Membership Application Status

Check status, continue an application, upload documents, or send a secure message.

Loan Payments

Make a one-time payment for non-real estate loans using SpeedPay.

Schedule an Appointment

Schedule an appointment with a specialist to discuss your personal or business banking needs.

Benefits & Offers

Whether you’re in need of personal banking or business banking, DCU has helpful tools & resources for you.

DCU Insurance

Auto coverage that’s right for you.

See how DCU Insurance can help you save.

DCU Insurance

Auto coverage that’s right for you.

See how DCU Insurance can help you save.

DCU in the Community

What makes Digital Federal Credit Union Different?

More Control for You

At a not-for-profit, member-owned organization, you’re an owner – not a number.

LEARN MOREBALANCESM Program

Helping you build a better financial future with free, trusted guidance; and resources.

LEARN MOREPeople Come First

It’s our mission to make a meaningful impact for our members and their communities.

LEARN MOREYour Opinion Counts

We invite you to share your feedback about DCU's products and services.

LEARN MOREDCU for Kids

Our 501 (c)(3) non-profit charitable foundation to benefit children and families.

LEARN MOREBank With Us From Anywhere

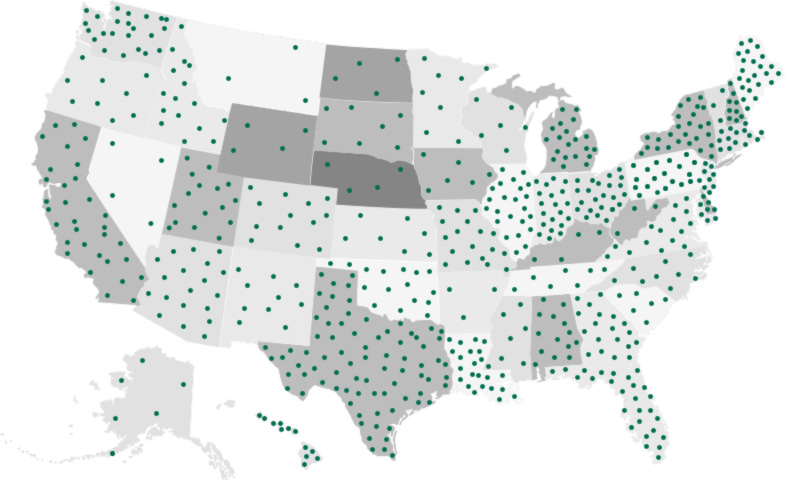

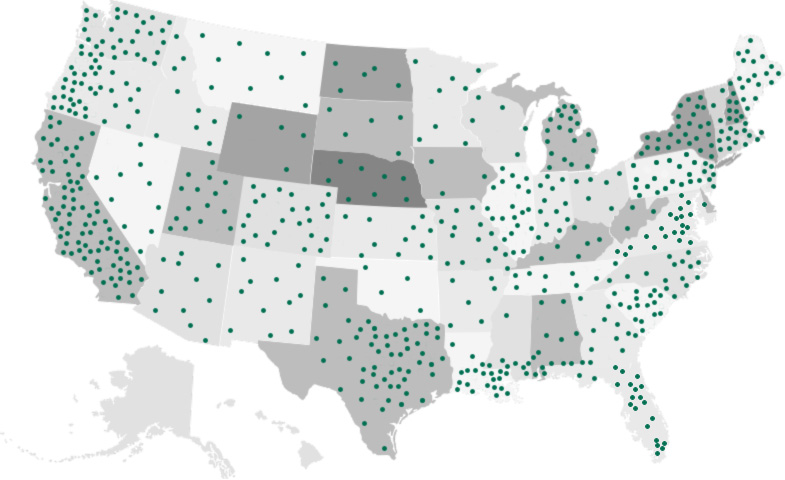

- 5,900+ Co-Op Shared Branches in the United States

- 80,000+ Surcharge Free ATMs in the United States

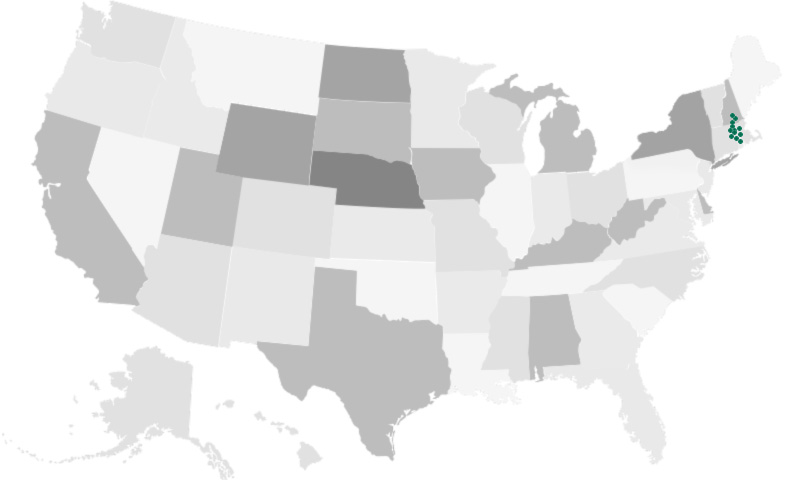

- 23 DCU Branches in MA & NH

- ATMs near your location